Filing income tax returns in Azad Kashmir is a necessary obligation for any person who earns taxable income. It’s more than just following the law. In fact, filing taxes on time even affects your NTN registration, banking affairs, property dealings, and, yes, visa applications.

Many individuals believe it is a very complicated and time-consuming process. But in reality, it is much easier and quicker than it is considered.

This guide will cover everything you will need to know about filing income tax in Azad Kashmir, right from who needs to file to collecting necessary details for your return, filing that return, and avoiding the most common mistakes.

Who Needs to File Income Tax in Azad Kashmir?

While not everyone is required to file an income tax return, especially in Azad Kashmir, specific individuals must be ensured to meet their obligations. For example, a salaried individual who earns a regular income, a business owner, or a shopkeeper who has their own enterprise.

Freelancers, consultants, or other self-employed professionals, and landlords who receive any income from rent must also include this income on their tax return. Any person who earns taxable income in accordance with AJK Laws must file their return.

Knowing the conditions that require filing can help you stay in the clear and encourage people to do their job guilt-free and penalty-free. By knowing where you stand, you can file confidently and efficiently.

Income Tax Authority in Azad Kashmir

The Inland Revenue Department of Azad Jammu and Kashmir (AJ&K) is responsible for collecting and managing income tax in the region. It operates under the AJK Council, and, in reality, its job is basically to ensure residents comply with local tax laws and to prevent tax evasion.

Unlike Pakistan’s Federal Board of Revenue (FBR), which governs tax matters in other provinces, the AJ&K tax system functions independently. Residents follow a slightly different process because the Federal Board of Revenue does not have jurisdiction in Azad Kashmir.

This means that all tax registration, return submission, and compliance procedures are managed locally through the AJ&K Inland Revenue Department, even though the steps are similar to those used by the FBR.

Documents Required to File Income Tax in Azad Kashmir

To file your income tax smoothly, you should get these documents ready.

- CNIC

- Salary certificate/ Income Proof

- Bank statements (if applicable)

- Business income details (if applicable)

- Property or rental income documents

- Previous tax record (if any)

Having all this stuff on hand will speed things up and reduce mistakes.

Read More:

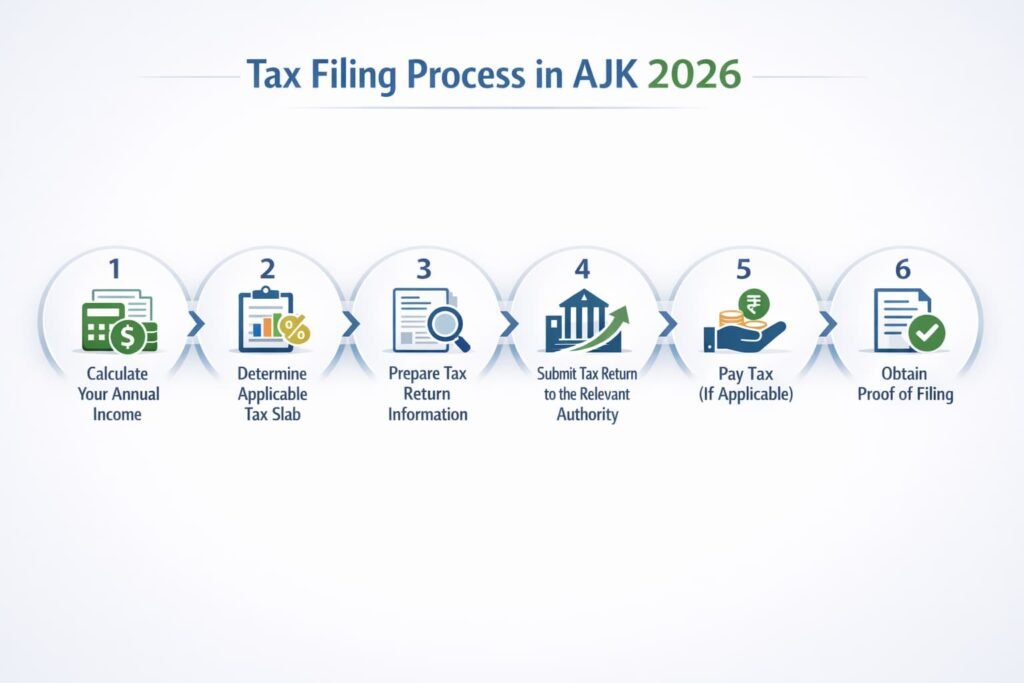

Step-by-Step Process to File Income Tax in Azad Kashmir

Step 1 – Calculate Your Annual Income

Include every source of income, including salary, business income, rental income, and any other income. Mention tax reductions and exemptions. An online tax calculator can help you with your estimation while filing your payable tax.

Step 2 – Determine Applicable Tax Slab

Check the tax slab that applies based on your total income. Salaried and non-salaried individuals may have different slabs.

Step 3 – Prepare Tax Return Information

Gather up all sources of income, deductions, and tax already paid. Verify all figures before filing the return.

Step 4 – Submit Tax Return to the Relevant Authority

Submit your return via the local tax office or an authorized tax practitioner. Both manual and assisted filing options are available.

Step 5 – Pay Tax (If Applicable)

Make the payment through a bank challan or other authorized channels if tax is due.

Step 6 – Obtain Proof of Filing

Download or save the acknowledgment receipt. This will help later through loans, visas, or other official requirements.

Common Mistakes to Avoid While Filing Income Tax in AJK

When filing an income tax return in Azad Kashmir, we could make some common mistakes that can cause delays, penalties, and incorrect submissions. Here are the major ones you should know about:

- Underreporting income: not including all sources of income.

- Missing deadlines: failing to submit the return on time.

- Incorrect tax slab selection: applying the wrong tax rate based on income type.

- Filing without proper documentation: not having a CNIC, salary proof, bank statements, or other required documents.

- Ignoring penalties: overlooking fines for late submission or mistakes.

For individuals unsure about calculations, documentation, or compliance, seeking professional income tax filing assistance can help avoid errors and penalties.

FAQs

Yes, anyone earning taxable income under AJK laws is required to file an income tax return.

The deadline is usually September 30 each year, but it is best to confirm with the AJ&K Inland Revenue Department.

Yes, freelancers and self-employed individuals must report their earnings and file income tax accordingly.

Failure to file can result in penalties, fines, and complications with bank matters or official documentation.

Conclusion

Filing income tax in Azad Kashmir might feel complicated at first, but it gets simple once you follow the right steps.

If you have all the required documents and actually take a careful look at your info, the whole thing becomes smooth. Watch the deadlines, know your tax rate, and you’ll avoid penalties.

Always calculate your tax before you file, and also, get professional help if you need it. With a bit of planning, filing your taxes can be simple, stress-free, and entirely in line with AJK rules.